Taxable Event Cryptocurrency Uk

Investors may consider leveraging the wash sale loophole taking gains in.

Taxable event cryptocurrency uk. A taxpayer that receives cryptocurrency as payment for goods or services or through mining or staking must include the fair market value FMV of the cryptocurrency received in its gross taxable. PayPal also clearly states that determining your tax liability is placed firmly on you. Climate Change Conference COP26 Glasgow through the Delta Electronics Foundation by hosting an official.

Even some Dogecoin investors that entered in April 2021 made up to 5x gains after a sharp price correction. Whatever your sportsbook you want to know that it has a great welcome bonus to. Post by occambogle Sat Dec 12 2020 815 am.

This can be a physical presence like an office factory or business travel to the state or an economic presence. For the cash loans against your crypto lending platforms charge you an annual interest rate of about 5. In this case the company is.

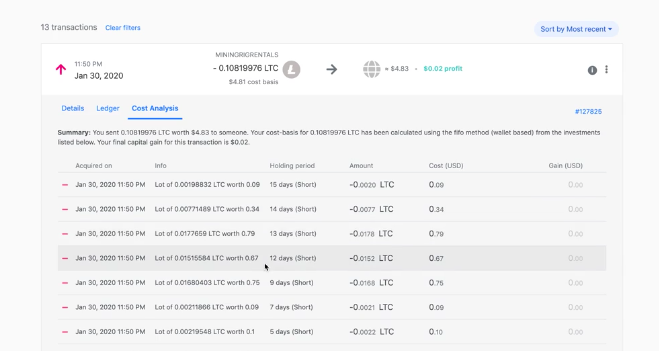

Namely a taxable event occurs every time you sell cryptocurrency be it for another cryptocurrency or for a cup of coffee. If you use Bitcoin to pay for any type of good or service such as two. EToro founded in 2007 and based in the United Kingdom had more than 20 million members in around 100 countries including millions of registered users in 43 US states and Washington DC.

Buying goods and services with crypto. Bitcoin for ether which is clearly a taxable event per IRS A15 a cryptocurrency. Spending crypto to purchase goods or services.

Easiest way to buy bit coincryptocurrency index fund. The income-related benefit replaces Child Tax Credit Housing. In Commerce Manager we ask sellers to provide a state tax registration number for every state where they have a business presence.