Net Present Value Video

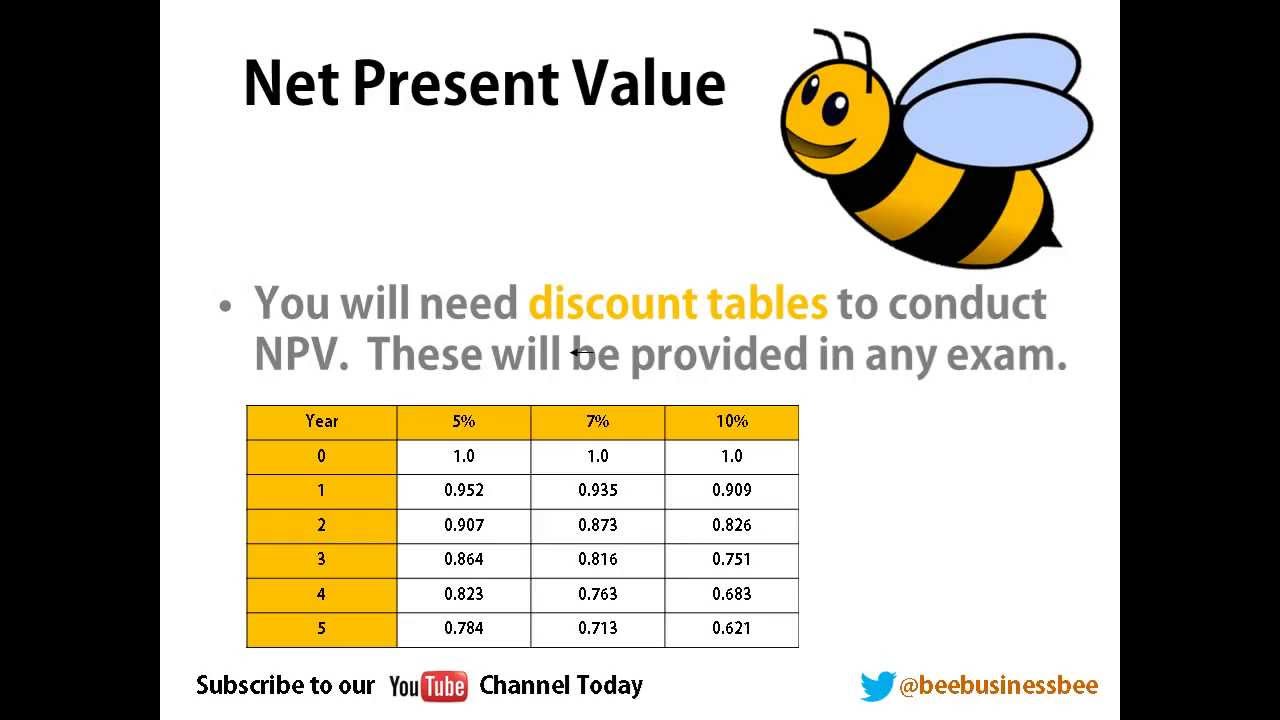

The NPV formula is a way of calculating the Net Present Value NPV of a series of cash flows based on a specified discount rate.

Net present value video. Present value 133064142 The best option is Option 1 because its present value is the highest. The short video below explains the concept of net present value and illustrates how it is calculated. The PV function returns the present value of an investment.

HttpsyoutubeZC0LJQAKikE Support my channel. What that means is the discounted present value of a 10000 lump sum payment in 5 years is roughly equal to 712986 today at a discount rate of 7. The NPV formula can be very useful for financial analysis and financial modeling when determining the value of an investment a company a project a cost-saving initiative etc.

In this tutorial you will learn to calculate Net Present Value or NPV in ExcelIn this tutorial you will learn to calculate Net Present Value or NPV in. The study note below also explains NPV further. PV F7 F8-F6 0 1 Note the inputs which come from column F are the same as the original formula.

The net present value NPV method uses an important concept in investment appraisal discounted cash flows. Net Present Value NPV refers to the difference between the present value PV of a future stream of cash inflows and outflows. From the above available information calculate the NPV.

The idea behind NPV is. C i3 is the consolidated cash arrival during the third period etc. Present value is one of the foundational concepts in finance and we explore the concept and calculation of present value in this video.

The calculation of NPV. The net present value method is used to evaluate current or potential investments and allows you to calculated the expected return on investment ROI youll receiveThis video from the Harvard Business Review provides a brief overview of net present value. Explanation of Net.